What's the Impact of Rising Discount Rates on Charitable Deductions?

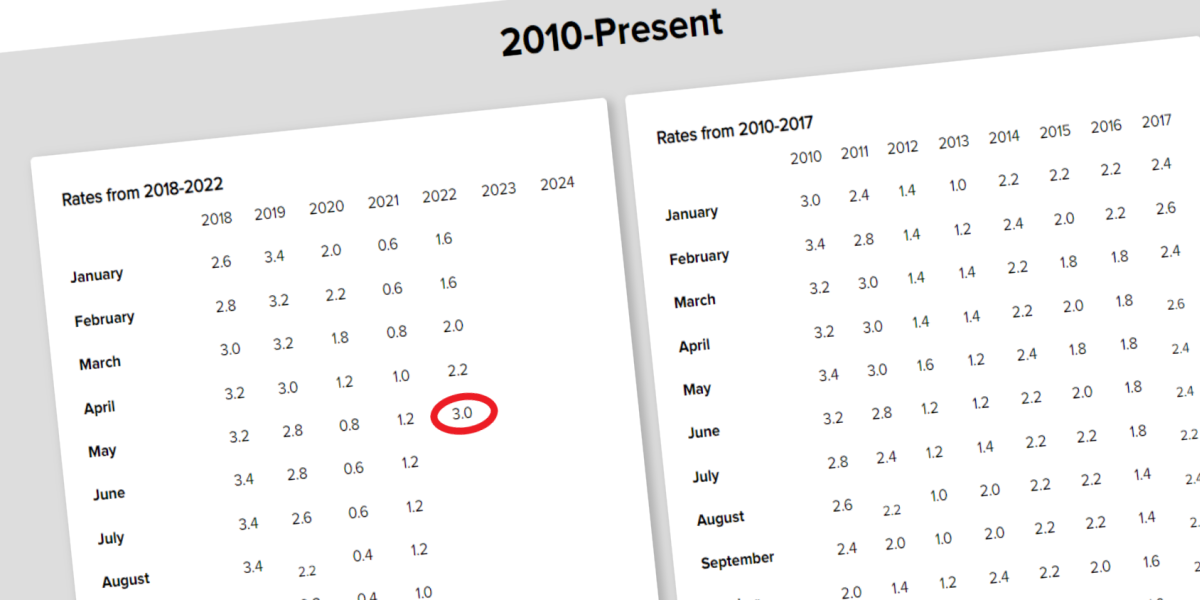

In May, the IRS discount rate (also known as the AFR, or Applicable Federal Rate) made its largest monthly increase since June 2004, rising from 2.2% to 3.0%. Your donors might be viewing this increase with dismay, as it makes new debt more expensive, from credit cards to home mortgages. But there is a reason to celebrate this increase, as it also increases the charitable deduction for the most popular life income gifts: charitable gift annuities and charitable remainder trusts.

Perhaps you’ve already seen this with a gift proposal you presented to a donor in April; when the gift date is delayed until May, the charitable deduction is greater. To understand how this happens, let’s take a step back and review how charitable deductions for these life income gifts are calculated.

Because a beneficiary, or beneficiaries, will financially benefit from a life income gift, the IRS does not allow a donor to take a one-to-one charitable deduction for the amount they gave away. Rather, that amount must be reduced by the value of the income the beneficiary stands to receive.

The income the beneficiary will receive 20 years from now, however, is not as valuable to them as the money they will receive today, particularly if the income is a fixed dollar amount. As time passes, the cost of living rises; your donor could buy more goods and services with $1,000 in 2000 than they can buy today, or than they will be able to buy 20 years from now. The IRS takes into account the time value of money by discounting the stream of income over the beneficiary’s life expectancy (or in the case of some trusts, the term of years).

Consider a 20-year term, 5% payout charitable remainder annuity trust (CRAT) funded with $100,000, resulting in annual payments of $5,000. If we discount the stream of income in PGM Anywhere’s Present Value tool, and use May’s discount rate of 3.0%, we find that $5,000 received three years from now will have the same purchase power as $4,575 received today, while the final payment of $5,000 in year 20 would have the purchase power of only $2,768 in today’s dollars. This is the effect of the discount rate over time.

The IRS allows a small amount of flexibility in calculating the charitable deductions, in that donors are allowed to choose the most favorable discount rate for the calculation. The IRS discount rate is published monthly, and donors can choose either the discount rate for the month of their gift, or the discount rate from one of the two previous months. (If your donor chooses a month other than the month of the gift, they must inform the IRS of this decision).

The higher the discount rate selected, the more the value of the beneficiary’s income will be reduced over time. When this discounted value is subtracted from the gift amount, it results in a greater benefit to the charity and a higher charitable deduction. Please note, however, that there is also an argument for using the lowest discount rate available under certain circumstances. Specifically in the case of a charitable gift annuity, if the donor is unable to use the charitable deduction, using the lowest discount rate possible will result in the highest amount of tax-free income. The difference will be relatively small, but this approach is best for donors who are not filing itemized tax returns.

The impact of a higher discount rate is particularly stark with fixed income gifts, like charitable gift annuities and charitable remainder annuity trusts. Consider the following example.

If on the last day of April 2022, a 72-year-old contributed $100,000 to establish a 4.9% charitable gift annuity, the highest (and most favorable) IRS discount rate available would be 2.2%. Discounting the projected life income at this rate, and then subtracting it from the gift amount, would yield a charitable deduction of $46,925. If this donor waited one day, establishing the same gift annuity on May 1, 2022, they could benefit from the 3.0% IRS discount rate, and the increased charitable deduction would be $50,028.

The effect of the IRS discount rate is more subtle when applied to the variable income produced by charitable remainder unitrusts. If the same 72-year-old donor established a 5% charitable remainder unitrust on the last day of April, the 2.2% discount rate would result in a charitable deduction of $55,434. Waiting for the first day of May and the more favorable 3.0% discount rate produces a charitable deduction of $55,580, a minor increase.

PGM Anywhere automatically updates the monthly IRS discount rates as soon as they are released. If your donor is choosing a rate other than the rate for the month of the gift, you can assist them with declaring that by generating the IRS Discount Rate Election Statement in PGM Anywhere, located within the Narratives section of Presentations.

It is important to keep IRS discount rate changes in perspective. While it may affect the timing of a donor's gift or influence a donor to choose a CGA over a CRUT, the discount rate is unlikely to be the deciding factor for establishing a gift. Rather, support of a charity’s mission is consistently cited by most donors as the most important motivation for making a gift. But in this time when rising AFR can cause sticker shock, the positive impact of higher discount rates is a welcome benefit for donors and charities.

Submit a Comment