Gift Annuity Contracts Filed with State Regulators and the Legacy IRA Act

As we’ve discussed in other blog posts, it is now possible to use a qualified charitable distribution (QCD) from an IRA to fund a charitable gift annuity (CGA). Among the specific requirements set forth in Section 307 of the Consolidated Appropriations Act, 2023 (“the Act”) is that the “income interest” of such an annuity be non-assignable. Our interpretation of the Act is that the income interest in a CGA may not be assigned to anyone, including the issuing charity.

Many gift annuity agreements, including those included in PG Calc’s PGM Anywhere and Planned Giving Manager (desktop) software, provide that the annuity is non-assignable “except that it may be assigned to the charity.” That exception is specifically provided for in Reg. Sec. 1.1011-2(a)(4)(ii), which allows for ratable reporting of capital gain when a long-term capital gain asset is used to fund a CGA if the annuity is non-assignable or only assignable to the charity issuing the CGA.

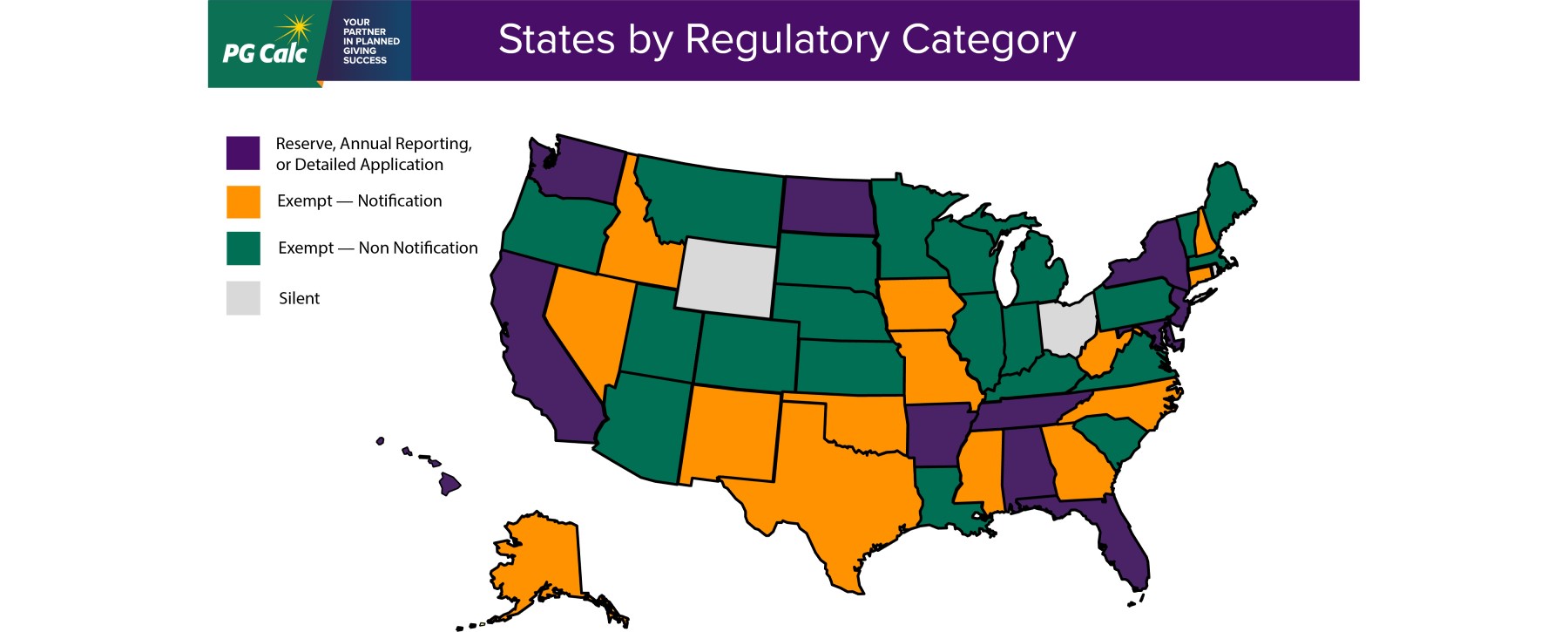

Since the Act does not specifically include the “or assignable to the charity” language with respect to a QCD funding a CGA, a cautious approach would be for the charity to modify its annuity agreement to remove that assignability to charity language. In most states, making such a change does not require anything further. However, in states where a charity is required to submit its forms of agreement for review and approval, removing fixed text (as distinguished from modifying variables such as names, dates, or dollar amounts) is not generally allowed without submitting new forms of agreement for approval. There are 9 states that require gift annuity contract forms to be filed as part of the initial registration:

- Alabama

- Arkansas

- California

- Maryland

- New Jersey

- New York

- North Dakota

- Tennessee

- Washington

Forms to Update

An update to PGM Anywhere was released on February 8, 2023, that includes QCD variations for four annuity agreement forms covering the following donor/annuitant scenarios:

- One life, donor is the annuitant

- One life, donor is not the annuitant

- Two lives, funded with separate property

- Two successive annuitants, donor is first annuitant

These will be for only immediate CGAs, since the Act does not allow for deferred annuities. Since the Act also limits the annuitants to the donor and/or the donor’s spouse, no variations that allow for a non-donor annuitant need to be revised. We have also opted not to create QCD versions of agreements with two donors. Such agreements traditionally contemplate contribution of jointly-held or community property, which is not the case with a QCD for CGA arrangement. We think it more clearly represents that each individual is contributing from their own IRA if a separate agreement is created for each donor. As a practical matter, once the agreements are signed, the annuity will operate the same as if there had been a single agreement, with one payment being made to the annuitant(s) and a single Form 1099-R issued each year.

How to Update

Whether you use the forms of agreement contained in our software or your own forms, you should submit to the applicable states any and all variations to which you are making changes. Each agreement should be submitted in prototype form, with variables noted as such. (You can generate prototype versions as well as gift-specific agreements from our software.) In your communication, note that you are already registered in the state and that you are submitting forms of agreement for review and approval. Indicate whether you are adding new variations, and thus leaving all previously submitted/approved forms as they are, or whether you are replacing previously submitted forms. If adding, any new variation will need to have a form number that differs from any previously submitted. If replacing, the same form number could be used but it would need to include a revision date.

You can submit your revised or new forms of gift annuity contracts via email, mail, or a filing portal, as noted below:

Alabama

bene.kyles@asc.alabama.gov

Arkansas

insurance.finance@arkansas.gov

California

CAB-SF-Intake@insurance.ca.gov

Note (added 7/8/24): California now charges a per agreement fee for submission of prototype agreements, per this schedule:

- for the first 10 agreements for which information is being filed: basic fee of $60.00 for each agreement

- for 11 to 20 agreements: 50 percent of the basic fee

- for 21 to 30 agreements: 20 percent of the basic fee

- for 31 to 40 agreements: 10 percent of the basic fee

- for 41 or more agreements: 5 percent of the basic fee

Checks payable to California Department of Insurance, and mailed to:

California Department of Insurance

Attn: CAB-Intake

1901 Harrison Street, 6th Floor

Oakland, CA 94612.

Maryland

Maryland Insurance Administration

200 St. Paul Place, Suite 2700

Baltimore, MD 21202-2272

New Jersey

june.duggan@dobi.nj.gov

New York

lifeformstatus@dfs.ny.gov

North Dakota

colicexam@nd.gov

Tennessee

https://vo.cloud.commerce.tn.gov/datamart/mainmenu.do

Note: this is the same portal used for filing the Tennessee annual report form/renewal. Under “Manage your license” there is an option to “update gift annuity forms.”

Washington

https://login.serff.com/serff/signin.do

Note: this is not the portal used for filing the Washington annual report form. It is a National Association of Insurance Commissioners filing portal, used by Washington for submission of agreement forms. If you don’t already have a login, you can find general information at https://www.serff.com/.

Submit a Comment