Research on Donor Advised Funds Presented at 2022 CGP National Conference

Dr. Danielle Vance-McMullen of DePaul University and Dr. H. Daniel Heist of Brigham Young University presented their preliminary analysis of data from 13,000 donor advised funds at the 2022 National Conference of Charitable Gift Planners last month.

While some of their findings confirm what we already know about DAFs, others challenge our common assumptions. The study, which examined data from 2017 to 2020, identified four key themes.

1) Donor advised funds involve a range of donors and charitable giving strategies.

- While 11% of DAFs had over $1 million in assets, the typical DAF is likely to be either a medium-sized DAF with assets between $50,000 and $1 million (45%), or a small-sized DAF with assets under $50,000 (44%).

- Approximately 18% of DAFs received annual contributions.

- A preponderance of DAF distributions are for unrestricted purposes; approximately 65% of transactions and 46% of dollars.

- Although DAFs are often promoted as an opportunity to facilitate family philanthropy, only 12% of accounts had three or more donors.

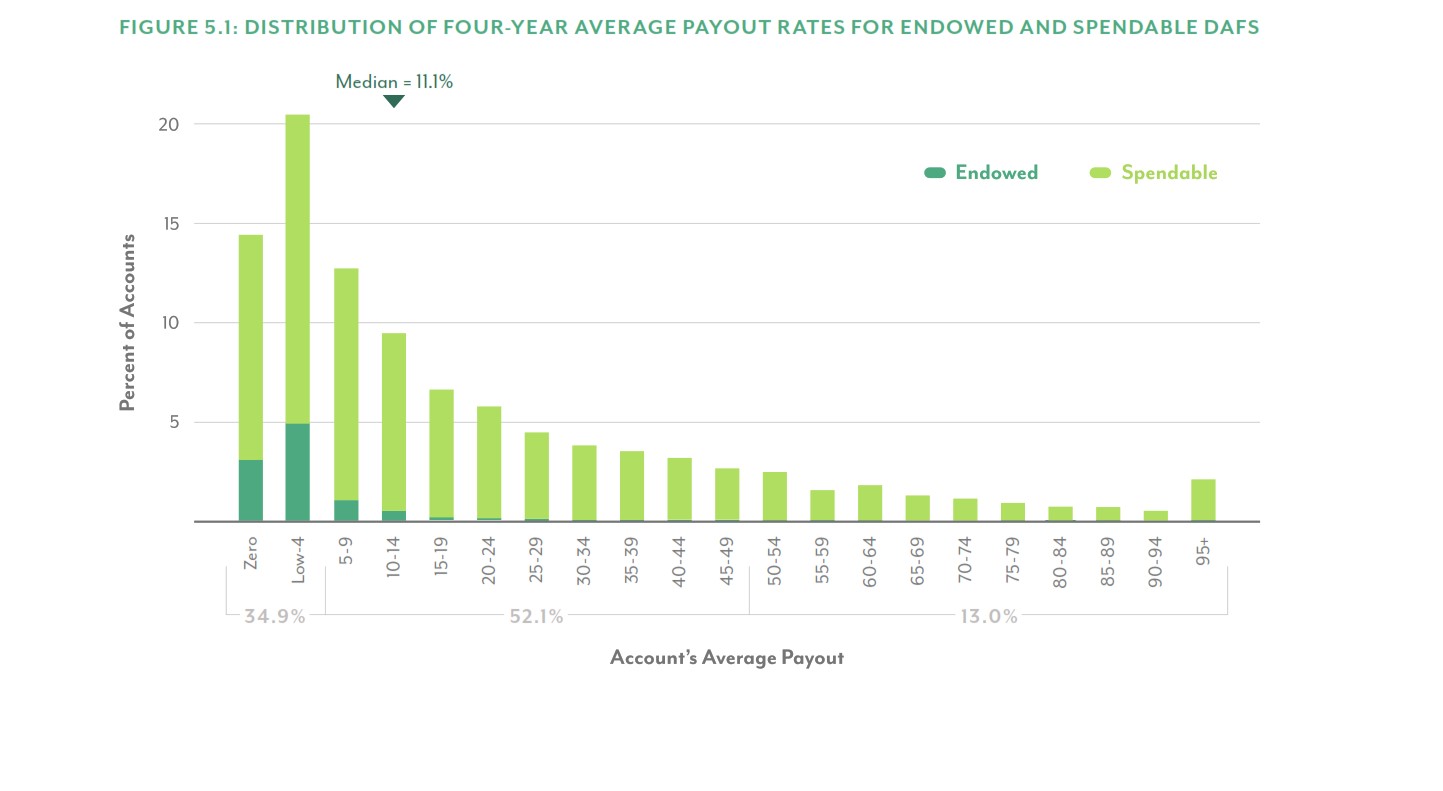

2) DAF payout rates reflect a wide range of giving strategies.

- Most DAFs (52%) had four-year average annual payout rates between 5% and 49%.

- About one-third (35%) paid out less than 5%.

- About one-seventh (13%) had an average payout rate of 50% or more.

- Another seventh (14%) paid out 0% during the four-year period examined.

- The median payout rate was 11% for all DAFs, 13% for spendable DAFs (as distinct from endowed DAFs).

- Most DAFs (71%) make distributions each year. Over the four-year period, 86% made at least one distribution.

- Most new DAFs (59%) do not make distributions in their first year. However, after four years approximately 42% had distributed their entire initial contribution, and another 22% had distributed at least half.

- DAF donors can be divided into three categories, dubbed “tubs,” “tanks,” and “towers.”

- Tubs fill up and drain their DAFs every 1-2 years.

- Tanks fill up their DAFs and then drain them steadily over 2-10 years.

- Towers fill up their DAFs and then distribute gifts at a rate that preserves their principal with the intention of perpetuating their DAFs for their lives or multiple generations.

3) A small number of large DAFs hold most assets and are responsible for most DAF distributions. Compared to small accounts, large accounts had lower median payout rates but more consistent grantmaking.

- Large DAFs ($1 million or more) represented 11% of all accounts and at least 85% of assets.

- These large accounts were responsible for 86% of the increase in distributions between 2019 and 2020. Overall, large accounts increased their distributions 142% over the four-year period.

4) Across all years, contributions to DAFs were concentrated in the fourth quarter; however, DAF distributions were spread more evenly across the calendar year.

- The majority of contributions to DAFs were received in the fourth quarter, including approximately 42% of transactions and 55% of dollars.

- DAF distributions tend to be more evenly distributed across the year, with only 41% of transactions and 30% of dollars occurring in the last quarter.

Scrutiny of donor advised funds, especially in legislative and regulatory circles, has tended to rely on single-year snapshot data. This research helps provide a deeper understanding of giving behaviors and the multi-year lifecycle of DAF giving.

The “Donor Advised Fund Research Collaborative” is an ongoing and joint project of Brigham Young University and DePaul University. More information is available on the Collaborative’s web site here: https://www.dafresearchcollaborative.org/

Submit a Comment