Giving USA Report Brings Good News for Gift Planners

2014 was a record year for philanthropy in the United States, according to the Giving USA 2015 Annual Report. There was a 7.1% increase in giving dollars over 2013 (5.4% adjusted for inflation). These numbers signal the return of pre-recession giving patterns. Some experts had predicted it would take 10 years for charitable giving to rise back to pre-recession levels, so the increases are heartening.

A few mega-gifts helped tip the scales. 2014 saw a number of gifts over $200 million and one of nearly $2 billion. The majority of these game-changing gifts were made by relatively young, tech entrepreneurs.

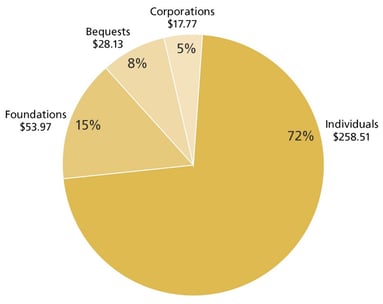

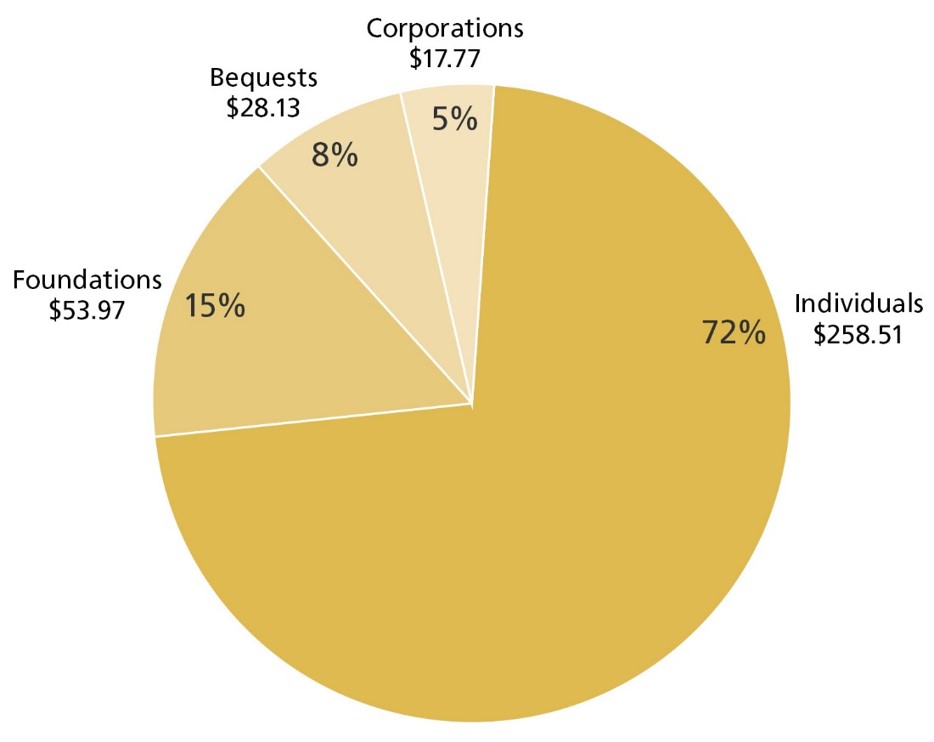

Giving By Source (in billions of dollars)

|

Source: Giving USA Foundation™

Bequest giving in particular increased 13.6% over 2013, which is good news for gift planners. Despite recent changes to national estate tax law, which included permanent adoption of high exemption amounts tied to inflation, the total number of bequest gifts has not changed significantly.

Rather, the size of bequest gifts is increasing. Today, the exemption threshold for estate taxes is $5.43 million per individual. Almost one quarter of estates that exceeded the exemption claimed a charitable bequest deduction in 2012, with estates worth $50 million or more claiming the largest proportion of all charitable deduction amounts. Another indicator of this trend: the grand total of estate gifts from the top 50 American donors increased 6.6 % in 2014, according to the Chronicle of Philanthropy.

Could this be the start of the intergenerational wealth transfer boom we’ve been anticipating for the last 15 years? Too early to tell, but something to keep an eye on.

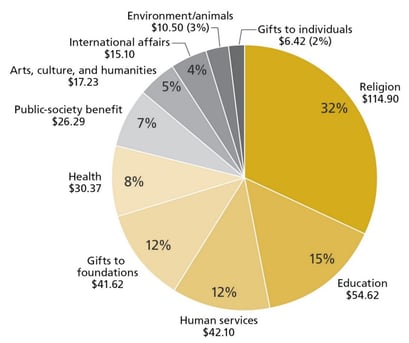

Giving By Recipient (in billions of dollars)

|

Source: Giving USA Foundation™

Giving by foundations as a fraction of all giving has steadily grown in every 5-year period from 1975 (6%) to 2014 (15%), almost entirely at the expense of individual giving. Some of this trend is due to the increase in donor advised funds sponsored by financial institutions, which count as community foundations. Nonetheless, the growth between 1975 and 1995 must be due to other factors. Fidelity Charitable Gift Fund, the first of these, didn’t start until 1991, and these foundations, as a class, couldn’t have been more than a rounding error until after 1995.

Religion, while the largest single category of philanthropy, continues to lose ground. In part, this reflects a demographic shift as fewer and fewer people belong to organized religions. But I also wonder if some religious charities push annuities too hard. Are they taking the $5,000 gift annuity when they could have had the $50,000 bequest?

International giving was the only area to decline – losing 2% to 2013. This is typical of years in which global scale disasters do not occur: Americans tend to turn to domestic philanthropic organizations.

Closing Thoughts

Charitable giving by average Americans continues to hover around 2% of disposable income. The record breaking increases in philanthropy come from the 1%.

In light of the increases in bequest gift amounts, gift planners may be wise to revitalize stewardship efforts in order to realize a donor’s full giving capacity. Regular contact – phone calls and visits – can lead donors to increase the amount of the gift in their wills, even toward the end of their lives.

These figures are based on the Giving USA 2015 Annual report, which is researched and written by the Indiana University Lilly Family School of Philanthropy. Get the full report.

Submit a Comment