Wait! Wait! Your Wife Is How Old?

How do you respond to a request by one of your organization’s strongest supporters for a two-life charitable gift annuity for him and his wife when you know that his wife is at least a couple decades younger than him? Let’s suppose that the donor is 71 and his wife is 47, for example. Would you be willing to entertain a discussion about a gift annuity written for the joint lives of these two individuals?

How do you respond to a request by one of your organization’s strongest supporters for a two-life charitable gift annuity for him and his wife when you know that his wife is at least a couple decades younger than him? Let’s suppose that the donor is 71 and his wife is 47, for example. Would you be willing to entertain a discussion about a gift annuity written for the joint lives of these two individuals?

As always, with these things, it depends. You would need to know that the funding assets are acceptable within the confines of your Gift Acceptance Policy; you would also need to know that the value of the funding assets meets your minimum requirements for a charitable gift annuity; and you certainly would need to know that the donor will accept the gift annuity payout rate recommended by the ACGA.

But what about those ages? Sure, he is 71 and well above your organization’s minimum age requirement for an immediate payout gift annuity (which is 65); but she is only 47 years old – 24 years his junior! Is your organization willing to issue a two-life gift annuity when the second person is so much younger and has such a long life-expectancy by comparison?

We ask this question because this topic comes up from time to time in our conversations with clients. We tend to hear about the organization’s minimum age requirement for gift annuities, but it seems generally that the restrictions are only applied to one-life gift annuities or to the first annuitant in two-life gift annuities. We rarely hear that an organization applies the minimum age restrictions to the second annuitant in 2-life arrangements.

You may be wondering, what difference does it make? Well, as we said before, it depends. Just how old is that second person? If the couple is relatively close in age, the combined life expectancy of the two individuals will be moderately greater than the life expectancy of the donor by himself. But if the second annuitant is dramatically younger than the donor, the combined life expectancy for the couple is going to be much greater than the donor’s alone. Here are some sample numbers:

|

1-life CGA |

Donor / first annuitant: 71 |

No second annuitant |

Life Exp: 15.2 years* |

|

2-life CGA |

Donor / first annuitant: 71 |

Second Annuitant: 69 |

Combined Life Exp: 20.6 years* |

|

2-life CGA |

Donor / first annuitant: 71 |

Second Annuitant: 47 |

Combined Life Exp: 36.4 years* |

Please know, we are not expressing an opinion on whether or not an organization should consider writing gift annuities for couples whose combined life expectancies extend well beyond 25 or 30 years. There will always be couples with significant age differences. Each organization ultimately decides on the most appropriate minimum age requirements, given other considerations. But we do think it’s important for gift planning professionals to understand the implications of writing a 2-life gift annuity when the second annuitant is much younger. With the significantly longer joint-life expectancy in this case, the gift planner is binding the organization to an annuity obligation that likely will go on for a very long time. Such arrangements should not be undertaken without careful consideration, no matter how important the donor might be(!).

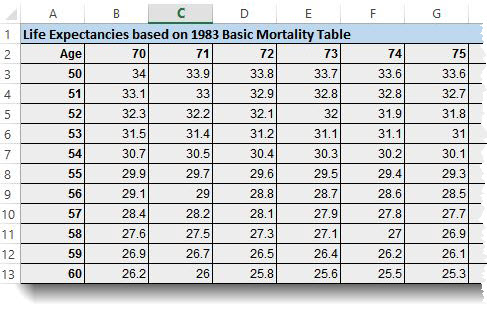

* Average remaining life expectancies for persons of these ages, based on the 1983 Basic Mortality Table. The IRS requires use of this table to compute the expected return multiples for charitable gift annuities (typically this is also the number of years in which annuity payments are partly tax-free). The 1983 Basic Table is a unisex table: it shows males and females to have the same mortality.

Submit a Comment