One More “To Do” Item - Gift Annuity Annual Reporting

If your organization is registered to issue gift annuities in New York, be sure that completion of the Annual Statement form (due March 1) is on your “to do” list. Unlike many states, where the filing is based on fiscal year end, the NY deadline is the same for all organizations. If you haven’t already done so, the 2014 form is available for download on the New York state website. One notable change this year: the reserve listing, which includes information on all annuities, must be filed in PDF form by all organizations (and also in Excel form for NY-based charities), but no longer needs to be filed in hard copy.

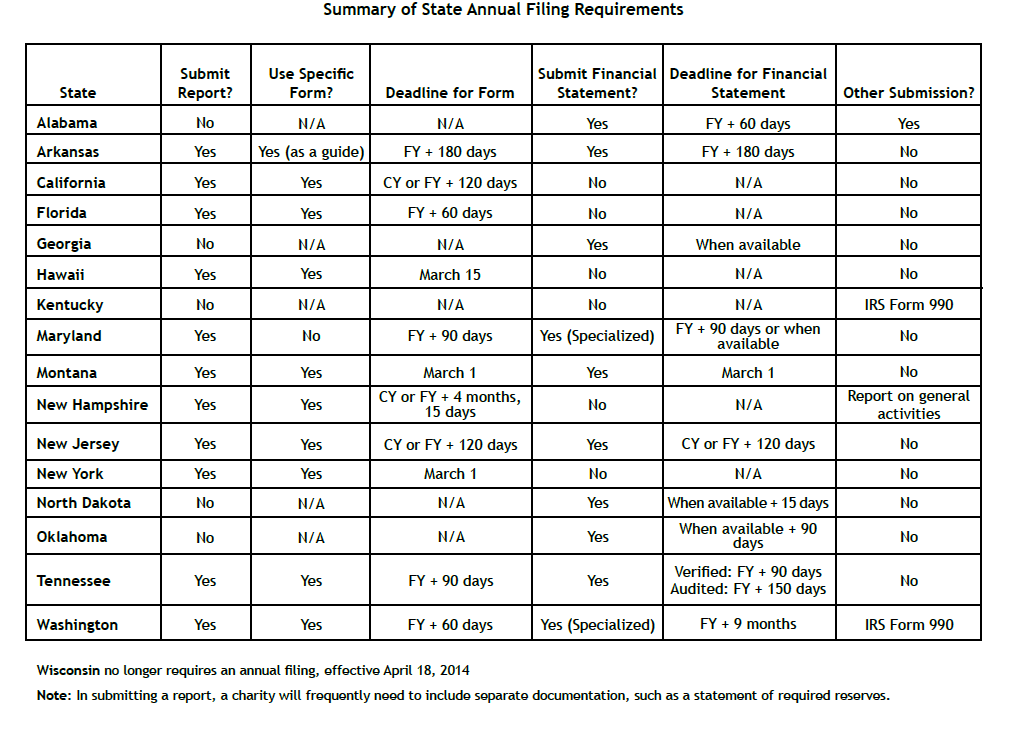

Other states with fixed filing dates are Montana (March 1) and Hawaii (March 15). California and New Jersey provide charities the option to request filing on a calendar year rather than fiscal year basis, so if your organization is registered in either of those states be sure you know your reporting period.

One happy reminder: Wisconsin, which previously had a March 1 deadline for annual reporting, no longer needs to be on your list. The change in law that occurred last April eliminated the annual filing requirement.

For charities with a December 31 fiscal year end, the annual reporting for states with such a requirement will be concentrated in the first two quarters of the year, while those with a different fiscal year end will have a different timetable. See the summary of state deadlines below.

This chart was taken from PG Calc’s “Charitable Gift Annuities: The Complete Resource Manual.” Download a free chapter from the manual.

Submit a Comment