Your Donor's Vote Counts (on Discount Rate Election)

You probably know already that the IRS allows donors to base their charitable income tax deduction for a life income gift arrangement on either the IRS discount rate for the month of the gift, or the discount rate for one of the 2 previous months. For charitable gift annuities and charitable remainder trusts, the highest discount rate results in the highest charitable income tax deduction.

You probably know already that the IRS allows donors to base their charitable income tax deduction for a life income gift arrangement on either the IRS discount rate for the month of the gift, or the discount rate for one of the 2 previous months. For charitable gift annuities and charitable remainder trusts, the highest discount rate results in the highest charitable income tax deduction.

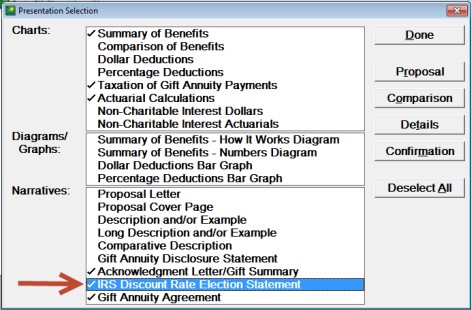

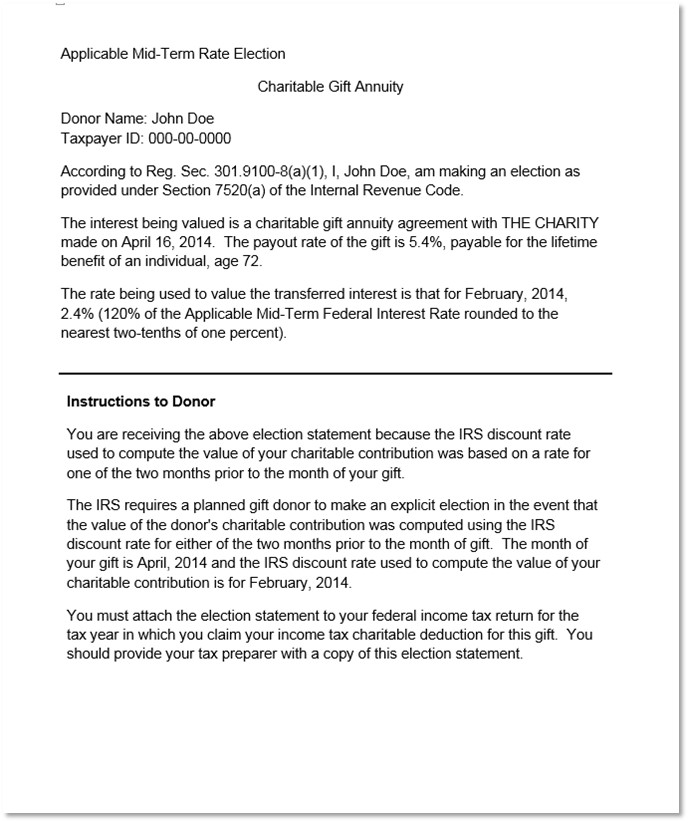

What you may not know is that the IRS requires donors to file an “IRS Discount Rate Election Statement” along with his or her tax return if they elect to use one of the preceding months' rates to compute the charitable deduction. But worry not! PG Calc’s Planned Giving Manager makes this process easy – all you have to do is include the IRS Discount Rate Election Statement as one of your choices under Narratives in the Presentation Selection window. In doing so, you will produce a one-page document that provides the form itself, as well as the instructions for the donor. We make it easy for you to do it right! (sample document below)

PGM options screen at left; see below for a sample of the form and instructions.

As always, don't hesitate to contact us with any questions about this form or the circumstances requiring its use!

Submit a Comment